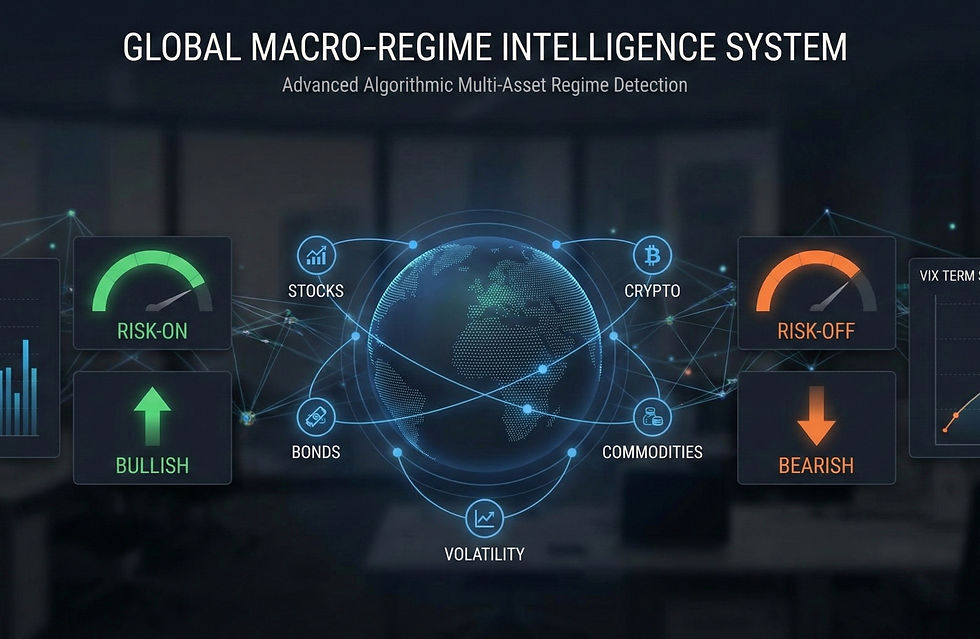

The AI based regime-detection engine for multi-asset portfolio management.

The Global Macro Regime Intelligence System is a professional-grade machine learning quantitative tool designed for traders, fund managers, and serious investors who need to look beyond price action and understand the underlying state of global markets — across equities, futures, sectors, crypto, commodities, bonds, volatility, and defensive assets.

Each daily scan transforms raw market data into a clear, powerful, and actionable classification of every asset: Bullish or Bearish, ranked, validated, and contextualized.

Your trading decisions are no longer based on intuition or subjective bias; they are anchored in machine learning and a macro-aware, multi-asset framework built to detect regime transitions before they appear in price. A premium intelligence layer for modern traders and investors.

What This Product Does

- Detects true market regimes using machine learning: Using Machine Learning Algorithms, the system analyzes the underlying statistical properties of price calculating the probability of the market being in a distinct state. This allows you to distinguish sustainable trends from noise-driven volatility.

This enables the system to detect:

- hidden shifts in trend strength

- transitions before price reacts

- volatility regime changes

- micro-cycles that traditional indicators cannot see

The model assigns each asset a quantitative regime label:

✔ Bullish (strong trend)

✔ Bearish (weakness / deterioration)

This is objective trend detection — not opinions or moving averages.

2. Quantifies Global Risk Sentiment as Risk-On or Risk-Off

The system simultaneously processes two distinct asset buckets:

- Risk-On: S&P 500, Nasdaq, Mega-Cap Tech (NVDA, AAPL), and Crypto (BTC, ETH).

- Risk-Off: US Treasuries (TLT, IEF), Gold (GLD), Utilities (XLU), and Low-Volatility Factors (SPLV).

Each asset’s regime contributes to a Risk-On Composite Index and a Risk-Off Composite Index, allowing you to track:

- global appetite for risk

- defensive positioning

- cross-asset confirmation

- stress, rotation, and regime conflict

By calculating a net Risk Index, the report reveals if capital is truly rotating into growth or fleeing into safety, providing a "Global Score" that dictates the overall market bias.

3. Integrates Volatility Term Structure (VIX Forward Curve)

The engine incorporates a "Macro Overlay" by analyzing the VIX term structure (Contango vs. Backwardation). It reads proprietary data streams to detect:

- Bullish Regimes: When volatility markets are calm (Contango).

- Turbulent/Scared Regimes: When the curve flattens.

- Bearish Regimes: When the curve inverts (Backwardation).

This acts as a failsafe, ensuring you never buy into a market where the volatility floor is collapsing.

4. Adaptive Algorithmic Learning Unlike static technical indicators (like RSI or MACD), this system uses a rolling training window (defaulting to 3 years) to re-learn the market structure daily, using a real Train–Test segmentation for out-of-sample validation. It adapts to changing volatility environments, ensuring that what was considered "high volatility" in 2019 is not falsely flagged in the current market environment.

5. Provides Actionable Regime Classification

The system synthesizes all data into a final, simplified output for every asset tracked:

- State 2 (Bullish): High probability of positive drift + stable range.

- State 1 (Bearish): High probability of negative drift + expanding range.

It answers the most critical question in asset management: "Is the mathematical environment favoring Long or Short exposure right now?"

6. Daily Global Risk Signal

From the combined behavior of:

- Risk-On composite regime index

- Risk-Off composite regime index

- VIX forward-curve sentiment contribution

- Multi-asset HMM transitions

the system produces a single Global Risk Score — an institutional-grade metric synthesizing the state of risk appetite across markets.

This score reveals:

- deep turning points

- macro regime rotations

- fragility zones

- systemic stress

- emerging opportunity windows

It is the quantitative heartbeat of global risk sentiment.

What This Product Helps You Achieve

✔ Filter out market noise: Ignore intraday chops and focus on the statistical state.

✔ See where the world is rotating: tech, crypto, bonds, defensives

✔ Dynamic Asset Allocation: Know exactly when to overweight Tech/Crypto and when to rotate into Bonds/Gold.

✔ Understand global risk appetite at a glance

✔ Detect macro regime shifts before they manifest in price

✔ Time entries with cycle-consistent signals and avoid trading against hidden volatility regimes

✔ Identify structural deterioration early

✔ Strengthen any system with a robust regime filter

✔ Improve portfolio allocation with probabilistic insight

✔ Manage Tail Risk: The VIX Backwardation filter warns of crash risks before they manifest in equities.

✔ Institutional Discipline: Replaces emotional decision-making with a standardized, probabilistic framework.

Who This Product Is For

- Discretionary traders seeking certainty and direction.

- Swing Traders who need to align with the dominant multi-week regime.

- Crypto traders seeking cycle context

- ETF and futures traders tracking cross-market confirmation

- Quantitative Traders looking for a state-based filter for their strategies.

- Macro Investors monitoring global rotations and seeking to visualize the flow of capital between asset classes.

- Portfolio managers adjusting risk dynamically

- Risk Managers who need early warnings on volatility spikes.

Why This Report Is Different

Because it models the market stochastically, not geometrically.

While other tools draw lines on a chart, this system calculates the distribution of returns and variance to determine the market's "Regime."

The result is a premium, algorithmic product combining:

- Machine Learning

- Cross-Asset Flow Analysis

- Volatility Term Structure

- Statistical and Probabilistic Range Profiling

Global Macro Regime Intelligence System

BlackFriday30% (Applies at CheckOut)

Subscription to a private Telegram channel for:

- Montlhy comunication of the list of instruments to be traded in the upcoming month. Signals will be provided at every first weekend of the new month.

- Immediate alert for Risk Off status and consequent rebalancing to avoid market crisis and relevant turbulence

- Periodical reporting on Portfolio Performances